Paul B Insurance for Dummies

Wiki Article

7 Simple Techniques For Paul B Insurance

For instance, let's intend you pass away an unforeseen death at a time when you still have a number of landmarks to accomplish like youngsters's education and learning, their marital relationship, a retirement corpus for your partner etc. Additionally there is a financial obligation as a real estate car loan. Your unforeseen death can place your family in a hand to mouth circumstance.

No issue just how difficult you try to make your life better, an unforeseen event can completely turn things upside-down, leaving you literally, mentally and monetarily strained. Having adequate insurance policy assists in the sense that at least you do not need to consider money throughout such a difficult time, and can concentrate on recovery.

Such therapies at good health centers can cost lakhs. Having wellness insurance in this case, conserves you the worries and anxiety of setting up money. With insurance coverage in position, any kind of monetary anxiety will certainly be dealt with, and also you can concentrate on your recovery. Having insurance coverage life, wellness, as well as liability is an important part of monetary preparation.

Facts About Paul B Insurance Revealed

With Insurance coverage compensating a big component of the losses businesses as well as families can jump back instead conveniently. Insurer merge a huge quantity of cash. Part of this money can be invested to sustain investment activities by the government. As a result of the safety worries insurance firms just buy Gilts or federal government safeties.

Within this time they will certainly collect a big amount of wealth, which returns to the capitalist if they endure. If not, the riches goes to their family. Insurance policy is a crucial financial device that assists in handling the unanticipated expenditures efficiently without much trouble.

There are broadly 2 kinds of insurance and let us understand just how either is relevant to you: Like any type of accountable person, you would certainly have planned for a comfortable life basis your earnings as well as job forecast. They additionally provide a life cover to the insured. Term life insurance coverage is the pure kind of life insurance.

If you have some time to retire, a deferred annuity offers you time to invest throughout the years as well as construct a corpus. You will get income streams called "annuities" till the end of your life. Non-life insurance policy is also referred to as general insurance and also covers any kind of insurance policy that is outside the province of life insurance coverage.

In the case of non-life insurance coverage, aspects such as the age of the possession as well as deductible will also impact your selection of insurance policy strategy. Permanently insurance coverage strategies, your age as well as health and wellness will influence the costs price of the strategy. If you have an automobile, third-party insurance policy coverage is mandatory before you can drive it when driving.

Some Of Paul B Insurance

Disclaimer: This short article is released in the general public passion and also indicated for general info functions only. Visitors are advised to exercise their caution and also not to rely upon the components of the post as conclusive in nature. Readers must look into further or speak with a professional hereof.

Insurance is a lawful contract between an insurance firm (insurance provider) and also a private (insured). In this case, the insurer guarantees to compensate the insured for any losses sustained due to the covered contingency occurring. The contingency is the event that leads to a loss. It may be the insurance policy holder's death or the residential property being harmed or ruined.

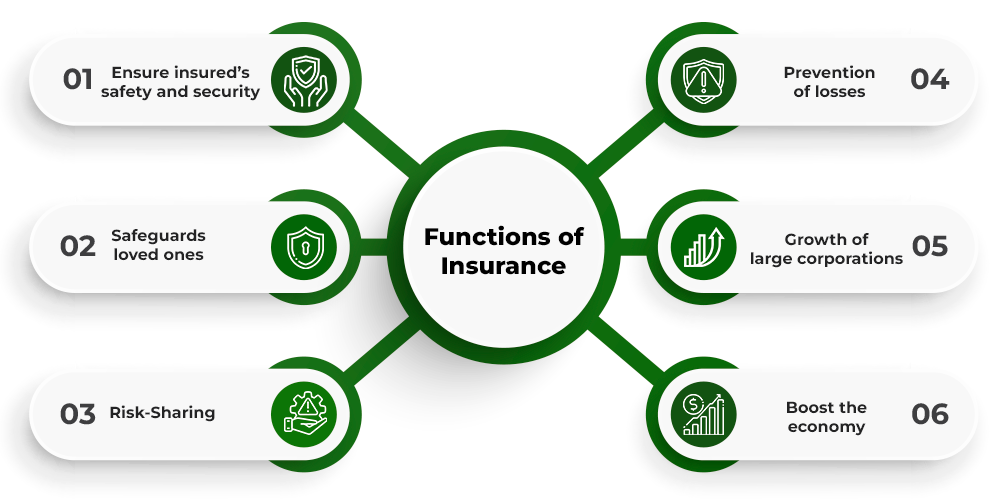

The main functions of Insurance are: The essential function of insurance is to protect versus the opportunity of loss. The moment and also amount of loss are unforeseeable, as well as if a danger occurs, the individual will certainly sustain a loss if they do not have insurance policy. Insurance coverage makes sure that a loss will certainly be paid and thereby safeguards the guaranteed from enduring.

pop over to this site

Paul B Insurance Fundamentals Explained

right hereThe procedure of identifying costs prices is also based on the plan's dangers. Insurance coverage gives settlement certainty in case of a loss. Better planning as well as administration can aid to minimize the risk of loss. In danger, there are different type of unpredictability. Will the danger happen, when will it take place, as well as how much loss will there be? In various other words, the occurrence of time and also the amount of loss are both unpredictable.

There are several secondary features of Insurance policy. These are as adheres to: When you have insurance, you have guaranteed cash to pay for the treatment as you get correct financial assistance. This is just one of the vital additional functions of insurance coverage where the general public is secured from disorders or mishaps.

The function of insurance policy is to eliminate the stress as well as suffering connected with fatality and also home damage. An individual can devote their body as well as heart to far better achievement in life. Insurance policy supplies an incentive to work hard to better the individuals by safeguarding society versus massive losses of damages, devastation, and also fatality.

her latest blog

The 5-Minute Rule for Paul B Insurance

There are numerous functions and relevance of insurance coverage. Some of these have actually been provided listed below: Insurance cash is purchased various initiatives like supply of water, power, as well as highways, adding to the nation's overall financial success. Instead of focusing on a solitary person or organisation, the risk impacts various individuals and organisations.

Insurance policy policies can be made use of as security for credit. When it comes to a house loan, having insurance protection can make getting the funding from the lender much easier.

25,000 Section 80D People as well as their family plus moms and dads (Age less than 60 years) Amount to Rs. 50,000 (25,000+ 25,000) Area 80D Individuals and also their household plus parents (Age greater than 60 years) Amount to Rs. 75,000 (25,000 +50,000) Area 80D People and their family members(Any individual over 60 years of age) plus moms and dads (Age more than 60 years) Amount to Rs.

The Buzz on Paul B Insurance

All kinds of life insurance policy plans are readily available for tax exemption under the Income Tax Act. Paul B Insurance. The benefit is obtained on the life insurance coverage plan, entire life insurance policy plans, endowment plans, money-back policies, term insurance, and Device Linked Insurance Policy Program.

Every person must take insurance for their well-being. You can pick from the various kinds of insurance policy as per your requirement.

Insurance promotes moving of risk of loss from the guaranteed to the insurer. The fundamental principle of insurance is to spread risk amongst a big number of people.

Report this wiki page